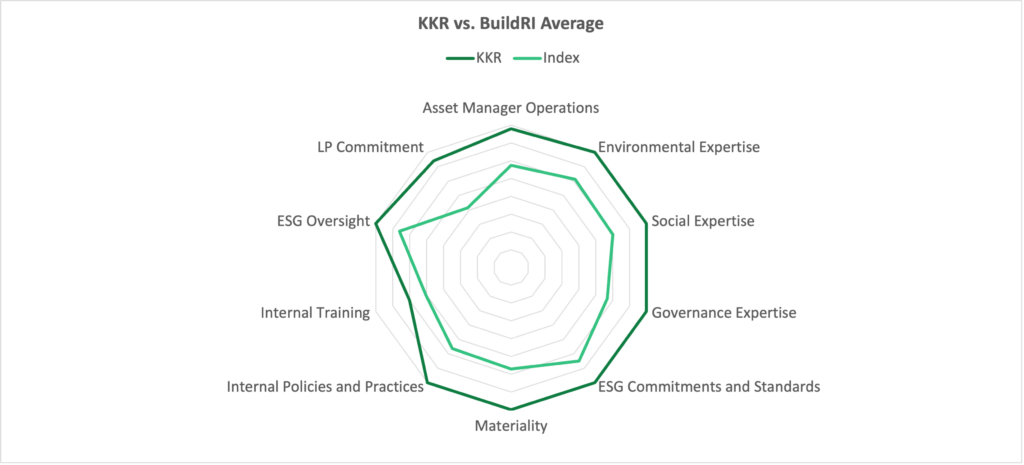

Our team has recently completed another round of in-depth reviews of responsible investment and ESG disclosures made by private equity firms and limited partners across North America and Europe and shares our key observations about KKR’s approach.

Key Observations:

1. Diversity Remains Paramount: The emphasis on diversity remains strong among both limited partners and investment managers, evident from the participation in ILPA’s Diversity in Action initiative, now with over 300 signatories

2. Inconsistencies in Reporting: Many managers frequently mention terms like “DEI” or “Diversity.” However, a closer look reveals that their data often remains high-level and lacks granularity. This is a trend observed even among some of the industry’s giants

3. Spotlight on KKR: Our research has been particularly impressed by KKR. Among the firms reviewed, KKR has set a commendable benchmark in transparency related to their diversity programs:

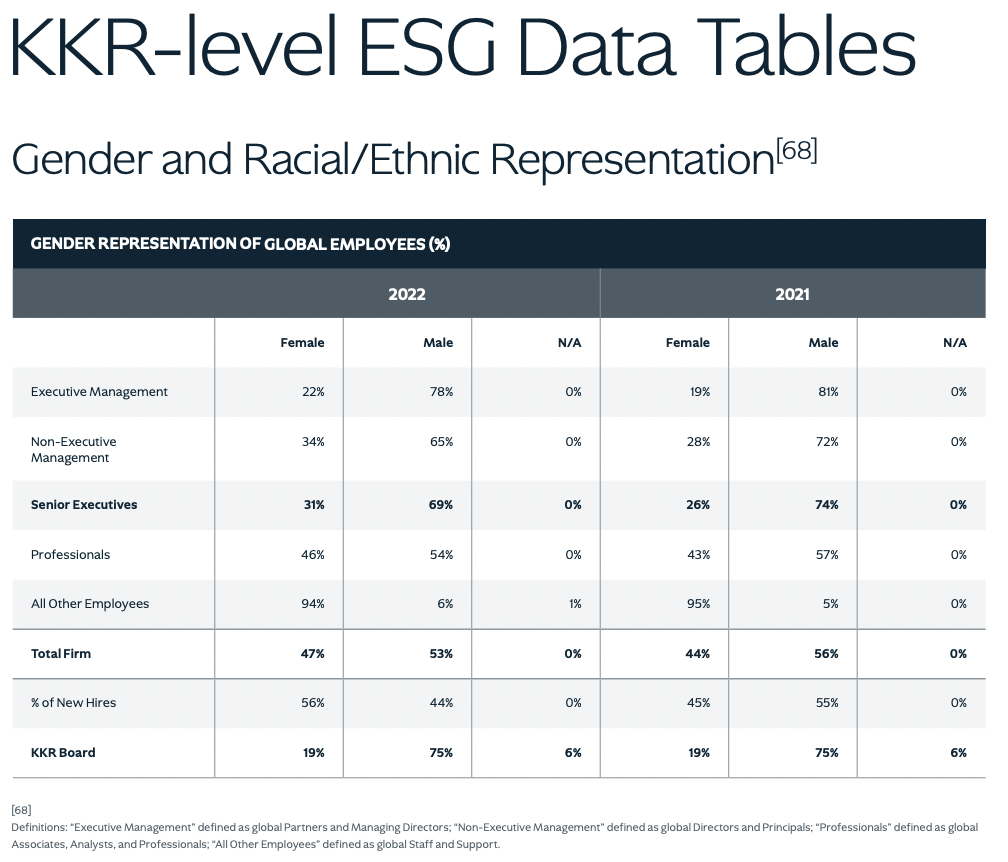

–Multi-period Measurements: KKR is ensuring consistent tracking over time, allowing stakeholders to observe trends and progress

–Granular Reporting: They provide detailed disclosures on gender representation on a global scale and racial/ethnic representation for their U.S. employees. Their approach serves as an industry exemplar in transparency and commitment

Why KKR’s Approach Matters:

1. Aligning with Investor Priorities: Limited partners are increasingly emphasizing these metrics in their evaluations

2. Building Trust: KKR’s commitment to transparency helps build substantial trust among both employees, investment candidates and limited partners

3. Employee Satisfaction: Comprehensive and transparent reporting reflects a genuine organizational commitment, attracting a diverse and talented workforce

We will be sharing further insights and detailed findings in the coming months, highlighting firms such as KKR that are setting an example for other firms and their portfolio companies via own good practice. In the meantime, please consider joining the BuildRI platform to access our private equity firm profiles, benchmarking, ratings and program management tools. Access to BuildRI is complimentary to verified limited partners.