As more investors and private equity firms navigate their ESG journeys, it is increasingly meaningful for the alternative investments industry to tie ESG investments to value creation. As a result of our ratings process on over 100 PE firm ESG programs, BuildESG has identified numerous case studies that achieved both financial and social returns via revenue growth, cost reduction, improved stakeholder relations and increased productivity. Please find below an example of one such case study from a portfolio company of Graham Partners, a US-based middle-market private equity firm.

| Value Creation Case Study: Graham Partners and its portfolio company, Mercer Foods, a provider of natural freeze-dried fruit and vegetables serving blue chip customers such as Starbucks, Kellogg’s and Trader Joe’s. GP and Portfolio Company Actions: During Graham Partners’ hold period, Mercer Foods invested in both employee health and safety programs and food waste reduction initiatives. Mercer Foods not only hired a third-party ergonomic consultant to engage directly with employees to address safety concerns and introduce job-specific stretching and correct posture during work activities but also invested in capital improvements, specifically a monorail system, that would reduce potential employee injuries when pushing heavy carts through the facility during production. Additionally, Mercer developed strong global vendor relationships and dragon fruit sourcing expertise, enabling the company to source and process with higher yields and less waste. Key Financial Results and Value Creation: As a result of these ESG investments, Mercer achieved an over 50% reduction in the rate of workplace injuries and illnesses (DART) between 2016 and 2019 to well below the industry average, resulting in lower workers’ compensation costs and a more productive and healthier workforce. Additionally, Mercer increased their freeze-drying capacity by 40%, resulting in a 12% annual yield improvement, saving over $5 million in associated costs from December 2020 through November 2021. Finally, the Mercer Foods case study provides a robust example for key stakeholders to understand how Graham Partners is “doing well, by doing good” in its 2021 ESG Report and contributes to its favorable BuildESG score in various categories. |

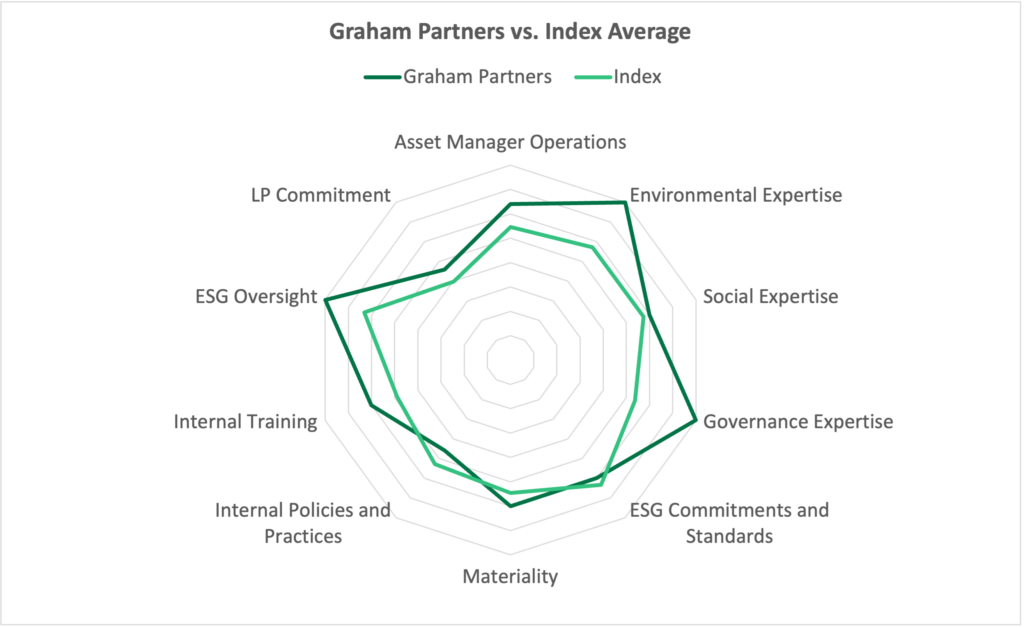

Graham Partners’ BuildESG Ranking: Top Quartile of BuildESG Index

Graham Partners’ BuildESG Score: 3.2 (Progressing category) out of 5

Sources: BuildESG analysis and Graham Partners 2021 Environmental, Social and Governance Report

BuildESG is a member-based ESG insights and intelligence platform and partner to LPs, PE/VC firms and portfolio companies that helps investors and their portfolios quickly improve operations, achieve greater value creation, optimize their ESG strategies and workflow, mitigate risk and signal maturity and resilience to stakeholders. Membership includes (i) data-driven ESG and value creation insights for investors, alternative investors and portfolio companies, (ii) purpose-built ESG workflow management software designed for the PE/VC community and (iii) full access to high touch advisory solutions, tailored training and tools provided by our team of 50 ESG industry leaders.