The BuildRI Framework & Assessment

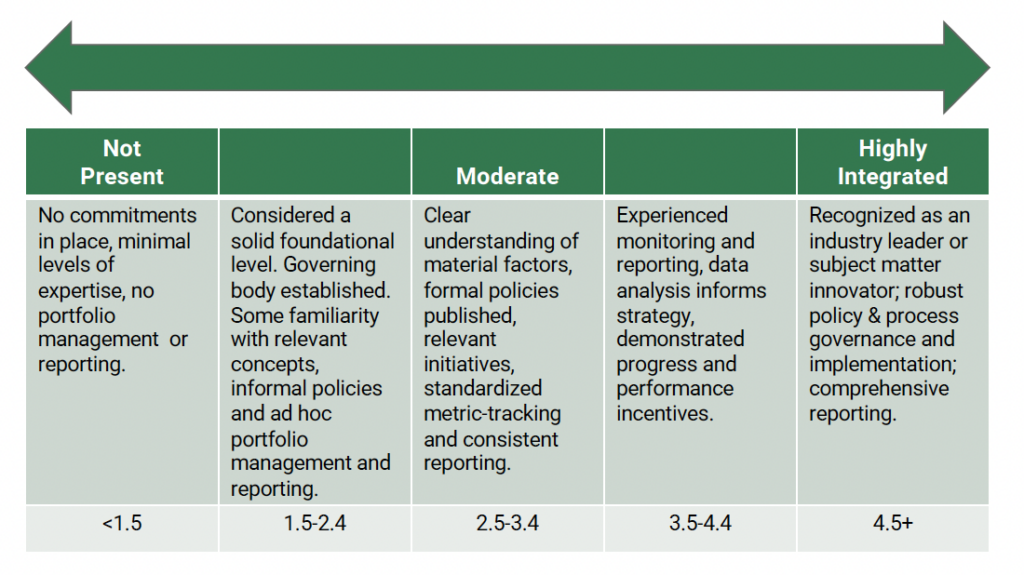

Our experts have developed a streamlined framework, or BuildRI score, suitable for the ecosystem of limited partners, investment managers and their portfolio companies. The BuildRI approach evaluates the practices, policies and processes (“PPPs”) inherent in a typical responsible investment program and applies a maturity-based scoring system to its input criteria.

For our Asset Manager ratings, our evaluation topics are segmented by category for Asset Managers. Evaluations are conducted by either the BuildRI member or the BuildRI team, which can be based upon public disclosure, private data and content or a combination of both. Ratings based upon private data and content are not disclosed publicly without the consent of the member.

Asset Manager Operations

- Expertise and Familiarity

- Commitment and Standards

- Materiality

- Internal Policies and Practices (Climate, DEI, Code of Conduct)

- Training

- Oversight

- LP Commitments

- Reporting

- Incentives

Portfolio Management

- Requirements and Incentives

- Investment Process

- Monitoring and Management

- Exit Planning

Our PPP-focused assessments are intended to evaluate the core foundation of a responsible investment program, applicable to most organizations. As a result, our assessments do not require or evaluate extensive quantitative data inputs. However, when it comes to key metrics that many standards evaluate, we recognize that each organization will find certain metrics, such as diversity or carbon reduction metrics, suitable to them. Our platform does offer a data collection feature for organizations seeking custom metric aggregation.

Our assessments incorporate ESG and responsible investment-related questionnaires and priority topics from leading industry associations and standard-setting bodies, including the Principles for Responsible Investment (PRI) and the Institutional Limited Partners Association (ILPA) and due diligence questionnaires from pension funds, endowments and other investment organizations. Our assessments are intended to be industry-agnostic by design for comparison purposes.

Individual scores for each question are averaged to calculate the score for each subcategory, such as ESG Oversight or Data Privacy & Security. Subcategories are averaged at the Asset Manager Operations and Portfolio Company Management categories. Asset managers are provided an overall score based on their performance in the main categories.

Scores represent an organization’s performance in ESG and responsible investment criteria based on input from the BuildRI team or a representative from the Asset Managers. Each answer is assigned a score from 1.0 to 5.0:

For more information or to request a demo, please email: info@build-ri.com